Broking Business: The new Consumer Duty – how to prepare for 2023

In July 2022 the FCA published details of its new Consumer Duty. Here’s a recap of the key points.

You’ll remember that the FCA released its policy statement (PS22/9) and finalised guidance (FG22/5) for a new Consumer Duty in the summer. This requires firms to consider the needs, characteristics and objectives of their customers, and how they behave, at every stage of the customer journey. The rules reflect a new consumer principle, obliging firms to not only deliver good customer outcomes but also understand and show how those outcomes are achieved at each stage. This means through sales, servicing, claims, and complaints (as applicable).

The FCA identified three core elements:

- A new consumer principle (which replaces current ‘principles 6 and 7’) requiring firms to deliver good outcomes for retail customers.

- Cross-cutting rules setting out how firms should act to deliver good outcomes. It requires firms to:

- Act in good faith

- Avoid foreseeable harm

- Enable and support retail customers to pursue their financial objectives.

- Rules and guidance relating to the four outcomes set to drive better firm-consumer relationships:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

Implementation and progress

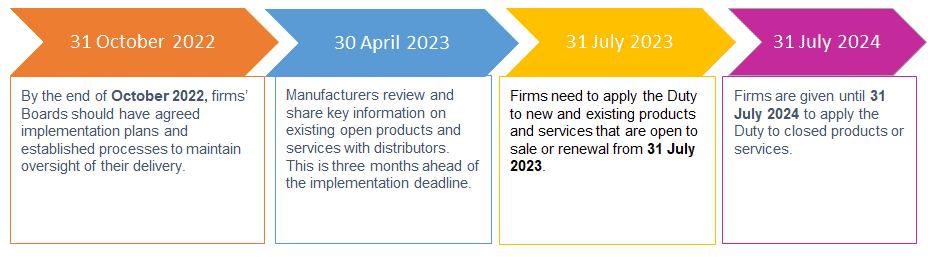

Alongside the detailed guidance, the FCA has provided clear implementation deadlines for firms to assess, analyse and implement the Duty.

The FCA was clear in its initial guidance and subsequent updates that firms needed to set clear plans to implement the Duty into governance, responsibility and ways of working. By 31 October 2022, firms should have completed this initial work and established implementation plans to drive actions.

This approach reflected a more proactive stance in the FCA’s supervision, and highlighted that It expects to see firms make real progress in identifying, assessing and addressing their existing products. Insurers must also engage with distributors to allow sufficient time for all parties to correct any weaknesses ahead of the formal deadlines.

Echoing the intentions of the FCA, it’s important that firms develop and implement their plans to identify, assess and embed the Duty across their products and services. Whilst firms have established processes to assess value and ensure effective governance surrounding the development and review of existing products, the ‘Duty’ requires firms to assess these products from a consumer view point. In developing their plans, firms should ensure they reflect the practical steps firms are taking to tackle areas of current weakness against the Duty. The plans should be supported by the Board and discussed regularly, so as to meet the 31 July 2023 date for new and existing product assessment.

In supporting these plans, firms should have identified a ‘Duty Champion’ role within their SM&CR framework. This role should support the work of the Board and ensure that the Duty remains high on their agenda and plays an important part in decision-making. The role should act to bring together the different aspects of the business covering the consumer journey and ensure that sufficient time is provided to embed the general and specific requirements throughout the firm.

Distributors may face challenges in establishing and maintaining effective communication with product manufacturers. The concern is that this could impede their ability to deliver by the July 2023 deadlines. Distributors and manufacturers must work together to assess products. It’s important that distributors receive the information they need well ahead of the July 2023 deadline, to allow time for new processes to develop and embed.

How we can help

PKF’s Governance, Risk & Control Assurance team can help you to assess the impact of the Duty on your firm. We can provide assurance as to whether your governance, oversight and controls are designed to meet the FCA requirements.

|

|

1) through specific, outcome-focused reviews considering each of the outcomes separately and tracking them across the consumer journey, or |

For more information, please contact Richard Willshire.