Capital Quarter Winter 2020: 25 Years of AIM

Over its 25 year history, AIM has admitted over 3,800 companies from around the world, raising £118 billion in equity capital. 61% of capital raised in this period relates to further raises which demonstrates the ongoing support AIM investors have provided to companies on the market.

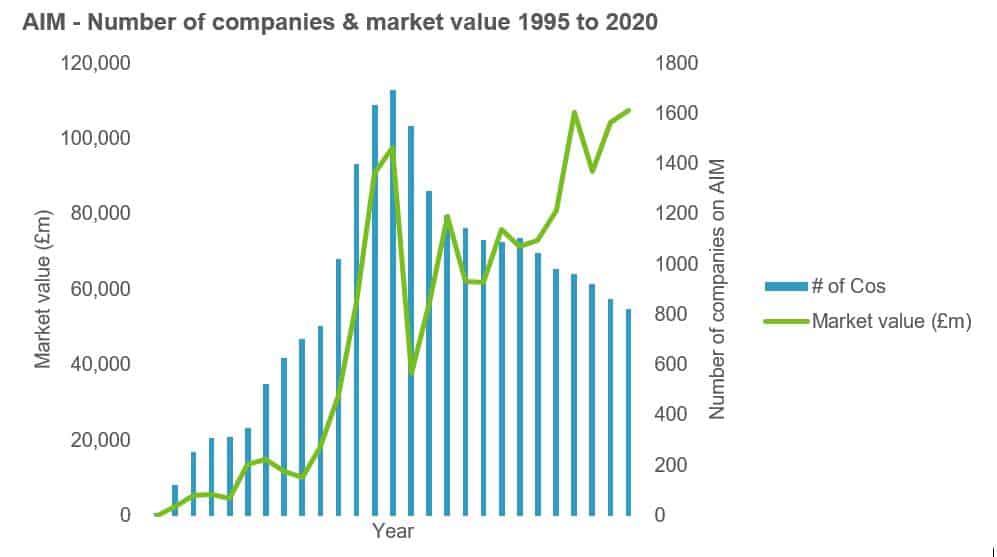

AIM’s goal, as a growth market, has been to provide access to public equity earlier than might be possible on traditional markets and then support these companies through their growth phase. The above graph would suggest they have been successful in this regard with the average market capitalisation of an AIM company increasing from circa £28 million in 2000, to £66 million in 2010 and to £131 million in 2020. By enabling growth-oriented companies to raise external finance at different stages in their lifecycle and helping them remain resilient throughout a changing business environment – as well as providing an exit route for early stage investors – AIM has played a significant role in the UK SMEs funding environment.

What next for AIM?

Over AIM’s lifetime, the funding opportunities for companies has altered considerably. ‘Early stage’ financing has become increasingly available through crowd funding, angel investments and peer-to-peer lending. This could be a risk to growth markets such as AIM, however it could also mean the market is used a platform for more mature businesses to secure further investment whilst giving an exit opportunity to founder investors. This trend may explain why there are increasingly fewer companies on AIM but the total market capital continues to grow.From January to May 2020, 158 companies have raised over £1.9bn in secondary capital on AIM. This could suggest that a listing on AIM provides some resilience and access to capital during the extremely unstable economic environment created by the Covid-19 pandemic and Brexit.

An AIM listing has been invaluable for these entities and continues to be a significant route to funding for SMEs around the world.

Key statistics on AIM today:

- AIM has admitted over 3,800 companies from across the globe, with 79 countries represented on the market.

- Combined, these companies have raised £118bn; 39% at admission and 61% through further fundraising, highlighting the long-term nature of support provided by investors to companies on the market.

- 53% of AIM-quoted companies have a market capitalisation above £25m, compared with one-third in 2000.

- 37 AIM companies carry London Stock Exchange’s Green Economy Mark, which recognises London listed companies that generate more than 50% of their total annual revenues from green products and services. These 37 companies have raised £656 million on admission and a further £1.5 billion in follow-on fundraising.

Our extensive IPO experience means we know what works and how best to go about achieving a successful IPO. We have a strong network of trusted advisors including lawyers, brokers and PR advisers and we are always willing to share our contacts who can ensure that you receive the best, and most suitable, representation.

Please get in touch with your usual PKF contact if you would like to discuss any aspect of AIM or the admission process.